To shop for a home is among the most significant economic actions some one make, both in life and you will enough time-identity economic believe. And one of the biggest stages in purchasing a house is getting best mortgage. Providing these types of five tips can help always generate a beneficial choice.

There are numerous home loan solutions, plus they vary with respect to loan type of, rate of interest, therefore the period of the loan.

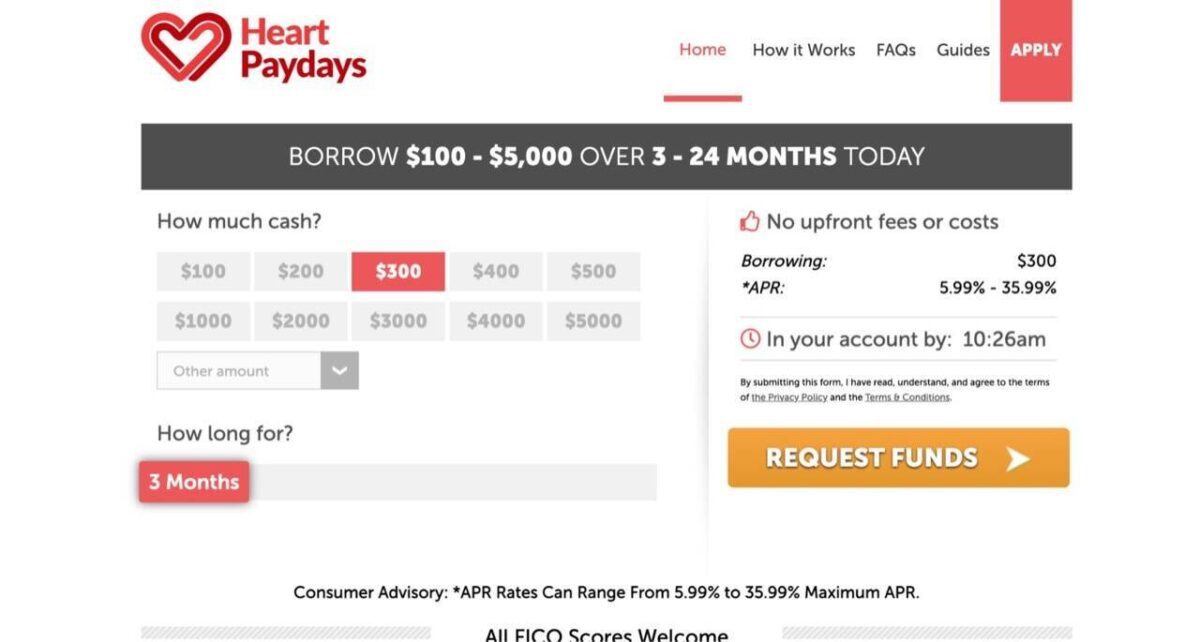

https://cashadvanceamerica.net/title-loans-wa/

Traditional financing become directly from a loan company. Federal Construction Government money or FHA money are for sale to some body with down credit scores and sometimes wanted a smaller down-payment. S. Agency off Farming.

Finance and additionally element both adjustable interest rate otherwise a predetermined attract rates. An adjustable rate of interest mortgage can be lower initially, but can change in the span of the loan, so that your mortgage repayment can go up or down on a regular basis. Having a predetermined price home loan, you lock in from the a particular rates and your costs sit a similar getting the life of your own financing. The life of one’s financing is named the mortgage title, and that generally was fifteen years or 30 years. An excellent 15-12 months mortgage enables you to spend the money for financing from in the course of time, your monthly payment might be greater than having a 30-year financial. A thirty-12 months financial gives straight down monthly payments, nevertheless shell out more notice on the mortgage through the years.

Keep in mind that which have any mortgage you choose you are going to likely have chances to refinance as the business interest levels and the worth of your home change. Mortgage loans having changeable rates is going to be changed into repaired attention rates, and you may vice versa. The expression of the mortgage can altered once you refinance. Rates of interest may shed on course of the mortgage your is also re-finance to create straight down monthly installments, whether or not it tends to make economic sense.

Understanding the options, the next phase is to look at your existing situation and you can what situations often feeling your property loan decision, each other directly and financially. Where will you be on your own job roadway? The length of time do you plan to get in our home your pick? Could you be capable make a frequent homeloan payment? How much cash have you got within the additional obligations, as well as how is the borrowing?

These types of issues helps you regulate how much money you prefer so you’re able to use for a mortgage, and how much you’ll be eligible for away from lenders.

When you are given mortgage solutions, make sure to take a look at all of the elements of the loan holistically. You can find visible what things to compare: The type of financing, rate of interest, and loan identity. However, there are many products that can enhance or take out of the complete give. Instance, issues was fees which you shell out side should you get the loan to reduce the speed and you will disappear money over the category of your own loan.

The loan could well be theoretically ultimately, you could getting positive that you chosen an effective device off an excellent place

Financing also come having closing costs, and therefore are different predicated on their bank and you will in your geographical area. Closing costs generally is actually a portion of your loan amount, and you may protection expenses associated with the loan app otherwise origination payment, mortgage underwriting commission, household appraisal fee, identity insurance, yield-pass on advanced, and you may credit file percentage.

Addititionally there is the cost of private financial insurance coverage (known as PMI), which is mandatory into the a mortgage unless you have significantly more than 20% of your own deposit. Home loan insurance is requisite and may paid back until you have enough 20% equity at your home. This insurance policies handles the newest bank’s portion of the loan if to possess any excuse you are not capable afford the financial.

When researching your options, it is very important have a solid understanding of exactly what for each and every lender offers. Then understanding how it can perception not only what exactly is due in the signing, but also their payment per month. Lenders have to give a loan estimate once they discover your application, hence mode directories information on the speed, repayments, and monthly settlement costs. Most of the lenders need utilize the exact same means, which can only help. However, coupons in one urban area can display upwards once the an expense in a separate urban area. Reviewing all loan alternatives very carefully is an essential action.

There are also fund offered using applications like the Experts Government or even the You

After you try for the ideal home loan and you may lender, you might go on to next tips on the way to family ownership. This may cover taking pre-approvals into that loan otherwise moving forward to accepting financing render. From that point it will require 30 so you’re able to forty-five days for a beneficial loan to close. At that point, you visit the mortgage closing, the place you comment and you will indication all the home loan documents. It is daunting, but exciting. Now you must to maneuver into the and you can unpack!

To invest in a house or investing in home can be a beneficial smart monetary move. Still its one of the biggest most significant monetary choices some body renders. By the committing to just the right mortgage, you possibly can make the most of money and you will earn collateral which can provide big payoffs later.

Within Guarantee Financial, we are happy to always address any queries that you may possibly have regarding to purchase another type of family and you will taking out a home loan. Contact one of our Mortgage Officers to help you schedule an appointment!