No deals are expected. The bank totally finances the acquisition of one’s brand new home. All you have to love will be your month-to-month mortgage payments. Musical high, does it not?

These money have the potential to allow consumers so you can safe good assets one to other banking companies wouldn’t thought providing them that loan toward. And also in Cayman’s newest market, sometimes it is the only way some one log on to the possessions ladder.

Added Expense

Simply because the rate from which the lending company have a tendency to charge your attract is significantly high. Just what you find yourself paying the lender as a whole focus (the amount of money paid back on top of the price along side title of one’s mortgage) is a lot greater.

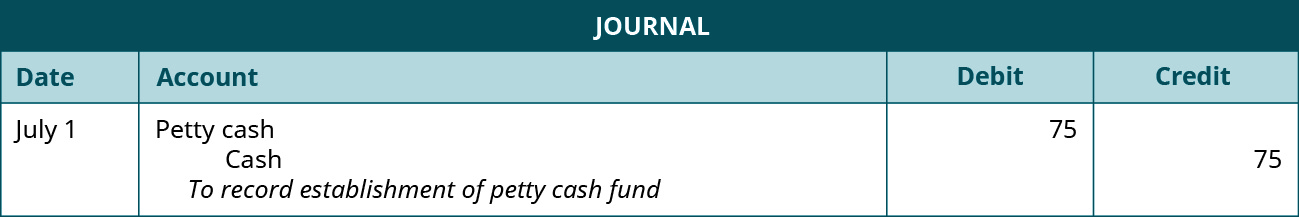

Below are a side of the side research regarding 100% resource and you can a basic mortgage. This example is dependent on present prices to finance a keen Isabela Locations homes lot, noted in the CI$29,700 regarding the Cayman Brac.

The financial institution is actually assuming greater risk whenever offering 100% financial support. Because of this, they costs a high rate of interest to make certain they generate the money back. Thus whilst you don’t need to give loans initial, your sooner or later spend so much more toward possessions.

The interest rate additionally the overall appeal along the financing identity are only a few items you really need to believe when comparing financial support selection. For standard information on mortgages, We recommend that see my personal previous web log: Mortgages during the Cayman.

Added Some time and Fret

To me, brand new institutions giving 100% resource mortgages wind up slowing down assets sales. How long between should your Bring are acknowledged so you’re able to the new Closing go out was considerably longer and often way more stressful – for everyone activities on it.

If it is not a location Class A lender on Cayman Islands, even “pre-approvals” do not always make sure you that loan. The loan application need certainly to get across numerous desks, and in some cases, come off-isle before they’re able to establish your loan.

Unattractive Proposes to Sellers

Sellers is evaluating their Offer to shop for so you’re able to other people. Needless to say, personal loans online South Dakota speed tends to be the biggest choosing factor, nevertheless number of conditions, the brand new schedule to close off, additionally the brand of capital can be determine if or not a merchant accepts an offer.

The time and be concerned that accompany 100% capital mortgages you certainly will dissuade suppliers away from taking the Provide. In short, the financial institution you select is place you at a disadvantage.

As a buyer, this may end up being discriminatory. Why must the vendor care and attention where you are getting the funds out of? Place on your own throughout the Seller’s footwear. If they can conduct the newest purchases of its property contained in this several months versus four weeks and avoid unanticipated facts, waits, and you will worries, after that obviously, they will stick to the extremely uncomplicated Render. They want to draw their property off the business although you function with their criteria big date which may be wasted should your mortgage isnt acknowledged.

Deposit Still Expected

In initial deposit, otherwise exactly what some will get label serious currency, is when customers let you know manufacturers they aren’t just throwing away day. It is similar to a security put on the sales itself – in case your profit experience, you have made your bank account straight back if you are acknowledged to own 100% funding. Yet not, you still need to obtain the fund on your membership, ready to lay out when you create your Give with the vendor. Such loans was up coming held during the escrow (a separate carrying account) before possessions purchase is done. Unfortunately, this is not strange, specifically for basic-big date people, seduced because of the 100% funding regarding lender, to miss wanting money into the put.