People envision applying for a home Equity Personal line of credit (HELOC) for assorted explanations. Appear to, he could be looking https://paydayloanalabama.com/five-points/ to create renovations or funds a school education. Sometimes, he or she is trying package an aspiration vacation or features a good back-up from funds on hand-in question of a crisis. According to your unique financial predicament, a beneficial HELOC may be the best next economic step to you.

What is an excellent HELOC?

HELOCs are designed to place your home’s guarantee to your workplace to have you. In other words, HELOCs may enables you to borrow secured on the latest collateral on your own domestic without having to pay out of your first financial. Which have a good HELOC, youre offered a specific line of credit, influenced by the worth of your home and leftover equilibrium to the your own mortgage. To own a basic example a few possesses property well worth $250,000, and currently owe $150,000 on their first mortgage. It indicates, in theory, he has $100,000 from inside the security. Yet not, the level of you to security they’re able to borrow on can differ, according to mortgage system.

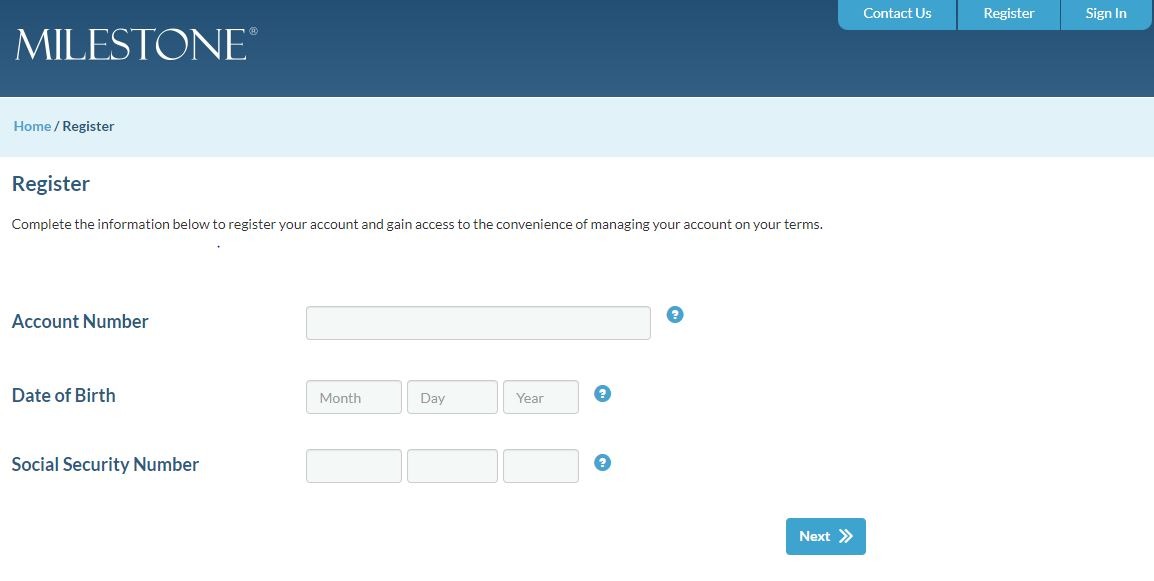

That have Camden Federal Lender, you can now get a good HELOC by way of our very own on the web app program MortgageTouch. From your mobile phone, pill or pc, you could potentially securely fill out all the called for files and advice and apply having comfort.

Just how can HELOC costs functions?

Good HELOC enables you to make inspections (taken from the appointed credit line) as required throughout the a specified time period referred to as Draw Several months, that’s generally speaking a decade. HELOCs usually are arranged which have a changeable interest, which means the pace you pay isnt repaired-this may increase otherwise off throughout the years.

From inside the Mark Months, you need to generate minimum payments predicated on your balance (you could usually spend even more). Depending on the mortgage, new payment tends to be according to research by the newest harmony, the brand new relevant interest, and other points. The brand new commission is also fluctuate as these numbers change

At the conclusion of the fresh Mark Months, you enter the Fees Label. During this time period, this new range can’t be put. Repayments for the existing harmony would be amortized along side Payment Label so you’re able to pay both dominant therefore the interest.

What are the trick great things about HELOCs?

To start with, you have to pay for cash you utilize (we.age. you will not have to pay appeal toward currency that you don’t have fun with out of your designated line of credit). At exactly the same time, cost can be lower than personal loans or handmade cards. You can implement immediately following to have an effective HELOC and you can, if accepted, you are able to new line of credit several times during the Mark Several months. Because you still build repayments, those funds be available for you to make use of once again into the Draw Several months. Percentage numbers is also versatile-your own fee can be lowest due to the fact appeal-simply fee, however you manage to lower the mortgage inside the area or perhaps in full at any time. Make sure that, yet not, you are aware what would cause very early closeout charges for the HELOC for individuals who pay back your debts very early.

Exactly what possible disadvantages can i thought?

Once the interest levels are at the mercy of changes, you might have increased percentage in the event the interest levels go up. If the idea of a varying interest rate enables you to afraid, you could thought a predetermined-speed loan, such as for instance a home Equity Loan, that’s a little distinctive from a beneficial HELOC.

At exactly the same time, if you use a great HELOC to combine large interest rate handmade cards, abuse is required to prevent a period out-of overspending. Making minimum money inside the draw period might not pay the range harmony. Remember this from inside the Draw Several months, and know your percentage will get increase notably whether it converts toward Fees Period. Definitely to consider their expenses models and you may potential for increased debt.

Interested in much more?

The knowledgeable loan originators try here to help you work through your very best options for HELOCs, HELOANs and refinancing your own financial. Our company is right here for you 24/seven from the 800-860-8821.