Building their custom home within the Tx was a dream to have of many, but it’s an aspiration that often depends on protecting the mandatory money. It tend to relates to navigating a complex network regarding economic difficulties. One of the main pressures out of manager-building try protecting financial support for the opportunity. In lieu of old-fashioned home buyers, owner-builders face unique criteria and possible hurdles whenever applying for fund. This web site article will give you valuable skills into the novel financing landscaping inside the Texas and provide simple suggestions to help your support the fund needed to bring your dream the place to find lifestyle.

Among the many great things about strengthening your own house into the Colorado ‘s the protection afforded by Colorado Homestead Work. That it legislation covers the majority of your residence away from financial institutions, getting a monetary back-up in case there is unanticipated activities. not, you will need to understand how the fresh Homestead Operate communicates with financing options.

Navigating the industry of loans, rates, and you https://paydayloansalaska.net/platinum/ will bank requirements is going to be daunting, especially for earliest-go out owner-developers

- Protecting Your own Guarantee: The fresh new Homestead Work means that their equity in your number one house can be excused off creditors’ says. This means that really sort of bills never force the fresh new product sales of your own homestead assets to satisfy those people debt. Which safeguard is very worthwhile throughout financial hardships otherwise bankruptcy proceeding procedures, enabling residents to maintain their first home. This can be a secured item whenever seeking to investment to suit your owner-builder investment.

- Influence on Financing: Because Homestead Operate protects their equity, this may dictate the fresh new conditions and terms of financing. Loan providers might have certain requirements concerning your papers of one’s homestead status to make sure compliance which have Texas laws.

In the Tx, loan providers wanted an effective Builder out-of Number getting active in the design processes. This requirement generally means a builder must be employed in the project to manage design.

Navigating the industry of finance, rates of interest, and you can financial criteria shall be overwhelming, especially for earliest-date manager-designers

- Understanding the Character: This new Creator out-of Number is responsible for making certain that the construction endeavor adheres to strengthening rules and you can laws. It act as a beneficial liaison involving the bank in addition to owner-creator.

- Trying to find a builder out-of Listing: If you’re not confident with the very thought of employing a standard contractor, you may have to select a professional private or organization in order to act as new Creator off Listing. This is when Established Green Individualized Land steps in to simply help you.

The Creator out-of Checklist specifications is principally designed to cover lenders. With a builder involved in the venture, loan providers is mitigate their chance and make certain the build is actually being done safely. It also provides a quantity of warranty on the lender one the project could well be accomplished on time and you may in this budget.

Since the Creator of Number demands can also add an additional coating from complexity for the manager-creator procedure, it has been a necessary reputation to possess acquiring resource. Additionally offer reassurance to your manager-creator, comprehending that an experienced elite group are helping manage the construction enterprise.

Interest rates enjoy a vital role in the total cost regarding their proprietor-creator endeavor. While lower rates can reduce the monthly obligations, it is critical to take into account the total price of one’s loan more its name. Below are a few factors to keep in mind:

Navigating the field of financing, interest levels, and lender standards will likely be challenging, particularly for first-go out holder-builders

- Financing Term: A lengthier loan title can cause straight down monthly premiums however, can also increase all round price of the mortgage because of focus accrual.

- Down payment: A much bigger down-payment can help you safe a reduced desire rate and relieve the general cost of the mortgage.

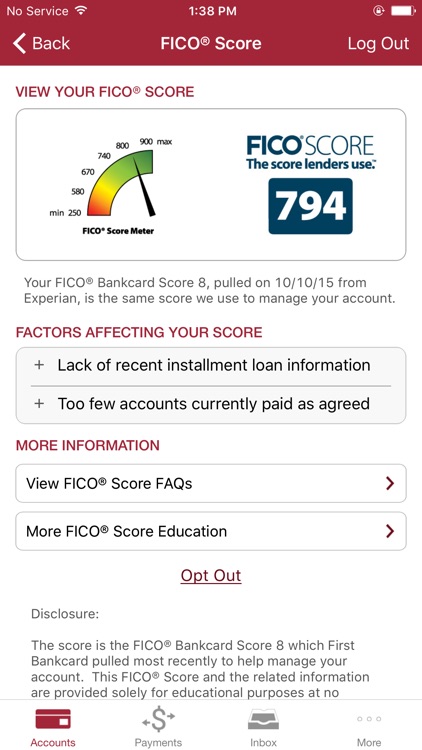

- Credit score: Your credit rating is a significant reason for determining the attention rate you’ll be able to be eligible for. Improving your credit history before applying for a loan can lead to higher terms.

Below are a few standard suggestions to make it easier to browse the financing landscape and increase your chances of securing financing for the Colorado proprietor-creator endeavor:

Navigating the realm of loans, rates, and lender standards can be overwhelming, particularly for very first-go out owner-designers

- Start Very early: Begin debt believed well in advance to offer oneself good-sized for you personally to conserve to own an advance payment and alter your credit get.

- Envision Pre-Approval: See pre-approval off a loan provider before you start the form techniques. This may leave you a much better idea of your allowance and you will help you to stand inside that finances as your preparations generate.

Within Centered Eco-friendly Custom Property, we understand the issues from securing funding for your Texas holder-creator enterprise. All of us out of advantages will provide worthwhile recommendations and you will help while in the the process. Since your Builder away from Checklist, we help you navigate the complexities of your Texas Homestead Operate and ensure conformity along with needed regulations.

I in addition to assist you in finding the most suitable resource possibilities, discussing that have lenders, and dealing with the project’s financial issues. With these options and commitment to your ability to succeed, you could potentially run building your perfect home even as we manage the new economic details.